What are Basel II and Sox Categories and how do you use them?

Basel II Category #

The Basel II guidelines provide a comprehensive framework for assessing risks within the banking sector.

They are designed to help banks identify and manage operational risks effectively.

These guidelines are an international standard that banking regulators can use.

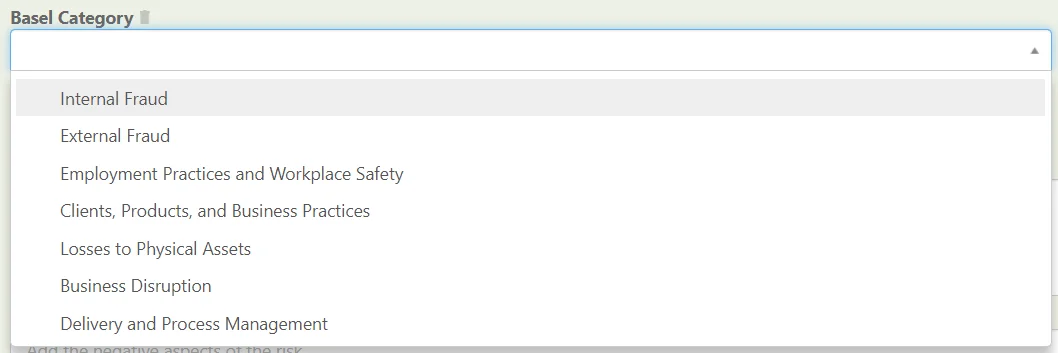

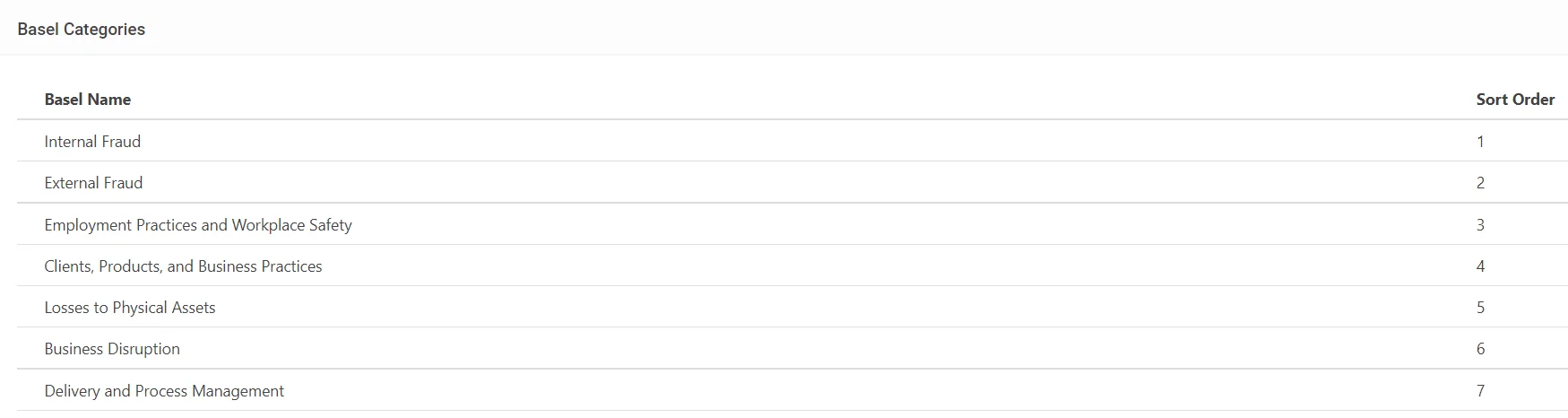

The Seven Recognised Categories are:

- Internal Fraud

- External Fraud

- Employment Practices and Workplace Safety

- Clients, Products, and Business Practices

- Losses to Physical Assets

- Business Disruption

- Delivery and Process Management

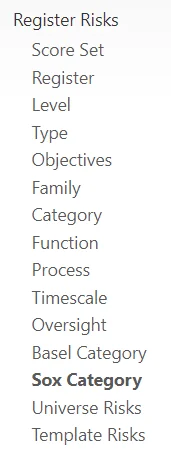

Assigning a Basel Category to a Risk #

When creating a New Risk select the Basel Category dropdown and select the category most appropriate to the Risk.

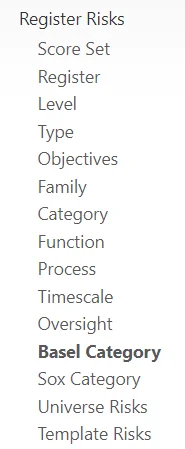

Accessing Basel Category Menu (Admin Only) #

Navigate to Basel Category under Register Risk Module on the left menu,

On the Basel Menu, you can add, edit and remove categories.

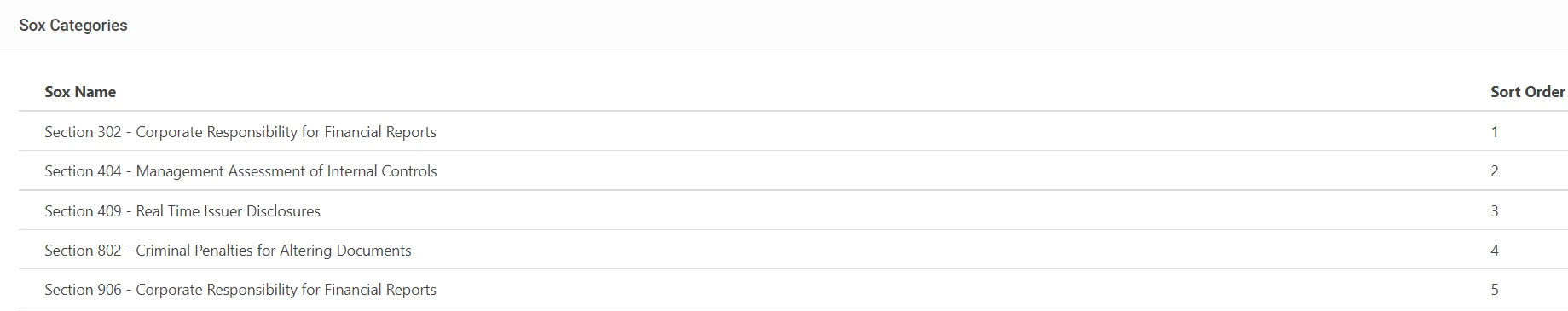

Sox Category #

The Sarbanes-Oxley Act (SOX) requires businesses that trade on U.S. stock exchanges to complete an annual management evaluation of internal controls over financial reporting (ICFR).

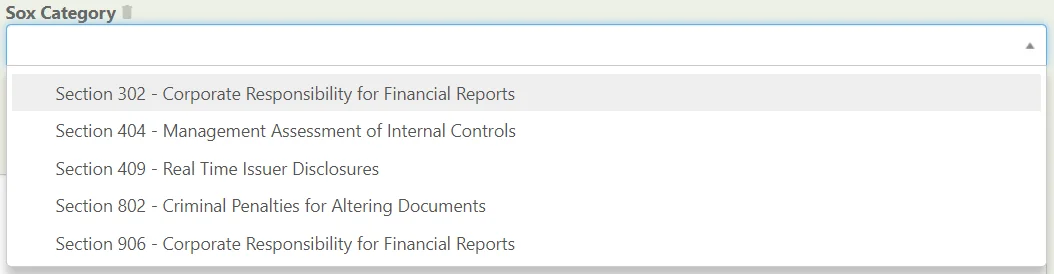

The exact SOX categories for Risk will depend on your particular approach however a general rule of thumb is to use the Sections as a starting place:

- Section 302 – Corporate Responsibility for Financial Reports

- Section 404 – Management Assessment of Internal Controls

- Section 409 – Real Time Issuer Disclosures

- Section 802 – Criminal Penalties for Altering Documents

- Section 906 – Corporate Responsibility for Financial Reports

Assigning a SOX Category to a Risk #

When creating a New Risk select the SOX Category dropdown and select the category most appropriate to the Risk.

Accessing SOX Category Menu (Admin Only) #

Navigate to SOX Category under Register Risk Module on the left menu,

On the SOX Menu, you can add, edit and remove categories.